BUYING YOUR HOME

with CityScape Metro Group

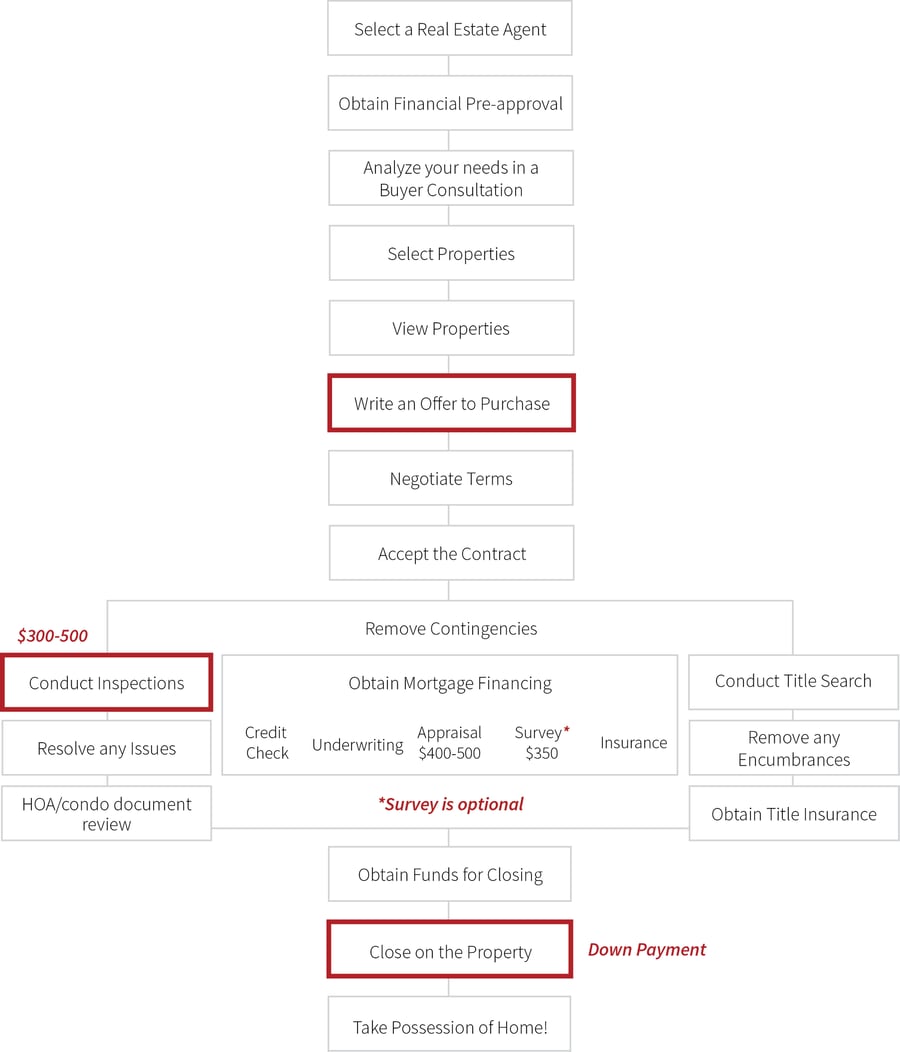

Overview of the Home Buying Process

You are about to embark on the exciting journey of finding your ideal home. Whether it is your first home or your tenth home, a retirement home, or an investment property, we will make your home-buying experience fun and exciting. We can help you find the ideal home with the least amount of hassle, and we are devoted to using our expertise and the full resources of our team to achieve these results! Below is a brief overview of the Home Buying Process, beginning with selecting a Realtor to work with.

As a licensed real estate professional, I provide much more than the service of helping you find your ideal home. Realtors® are expert negotiators with other agents, seasoned financial advisors with clients, and superb navigators around the local neighborhood. They are members of the National Association of Realtors (NAR) and must abide by a Code of Ethics and Standards of Practice enforced by the NAR. A professional Realtor® is your best resource when buying your home.

Let me be your guide...

I'll save you endless amounts of time, money, and frustration.

As an industry professional, I know the housing marketing inside-and-out, and can help you avoid the 'wild goose chase'.

I can help you with any home, even if it's listed elsewhere, or is being sold directly by the owner.

I know the best lenders in the area and can help you understand the importance of being pre-qualified for a mortgage. Our local lender expert will discuss down payments, closing costs, and monthly payment options that suit you.

I'm an excellent source for both general and specific information about communities, such as schools, churches, shopping, and transportation.

I'll help structure your offer to be the strongest for what your comfort level is, while also establishing rapport with the other side to ensure full transparency and effective communication.

And the best thing about me as your Realtor is that all this help normally won’t cost you a cent! Generally, the seller pays the commission to the Realtor.

We recommend our buyers get pre-qualified before beginning their home search. Knowing exactly how much you can comfortably spend on a home reduces the potential frustration of looking at homes beyond your means. It also can get you the upper hand when competing in a multiple offer situation.

Below are the typical steps in this process.

- Application and interview

- Buyer provides pertinent documentation, including verification of employment

- Credit report is requested

- Appraisal scheduled for current home owned, if any

- Loan package is submitted to Underwriter for approval

- Parties are notified of approval

- Loan documents are completed and sent to Title Company

- Title exam, insurance and title survey are conducted

- Borrowers come in for final signatures

- Lender reviews the loan package

- Funds are transferred via wire

We will go through an in-depth questionnaire to learn the ins-and-outs of what you're looking for in a property. Using that information, I will comb the market for homes meeting your criteria.

In some cases, my clients find their dream home on the first day. In other cases, it takes more time to find the right home. Rest assured, there is a home out there just right for you. We just have to find it.

ONCE WE NARROW DOWN THE LIST OF PROPERTIES, I WILL:

-

Provide you with more detailed information about the home and neighborhood

-

Review the county tax records for tax liens, etc.

-

Schedule a showing for us to tour the home

-

Determine how the asking price compares with other homes in the area

-

Reach out to the lender for an estimated monthly payment based on the asking price

-

Answer any further questions you may have

Once we've found the property that is 'THE ONE', we will write a purchase agreement. While much of the agreement is standard, there are several areas that we can negotiate:

If you can be flexible on the possession date, the seller will be more apt to choose your offer over others.

Structuring an offer with a quick close along with a rent-back for up to 3 months to the current owners can help win in multiple offer situations.

What you offer on a property depends on a number of factors, including it's condition, length of time on the market, buyer activity, and the urgency of the seller.

While some buyers want to make a low offer just to see if the seller accepts, this often isn't a smart choice, because the seller may be insulted and decide to not negotiate at all.

Waiving a home inspection can sometimes be necessary in a hot market. You are usually still allowed to do a home inspection for informational purposes only, to make you aware of any major issues that you will need to fix as soon as possible.

Waiving financing and appraisal means that if you do not qualify for the loan, or the appraisal comes in below what you need, you will still go through with the sale. In these situations, you'll need to be prepared to pay the appraisal difference out of pocket, should it come in under value. I will carefully walk you through this in detail if we consider waiving this option.

Often, the seller plans on leaving major appliances in the home. However, it's often a matter of negotiation on which items stay or go.

We will present the offer to the listing agent and/or seller, and stay close in touch with you about the status until we have a formal response. The seller will either ACCEPT the offer, REJECT the offer, or COUNTER the offer with changes.

Once the offer has been accepted and the contract is fully ratified, meaning both parties have fully signed and initialed all terms of the purchase agreement, you are officially 'Under Contract' - congratulations!

Now that we’re officially Under Contract, the Title Company will start preparation on their end. Depending on the terms of your purchase agreement, we also will work on satisfying any contingencies that might be in place.

CONTRACT CONTINGENCIES: |

ITEMS HANDLED BY THE TITLE COMPANY: |

- Scheduling and conducting a home inspection

- Delivery and review of homeowners association documents

- Conducting an appraisal, scheduled by the lender

- Securing financing with the lender, starting by sending it to underwriting

- Scheduling and conducting a well and/or septic inspection

Once this is received by the Title Company, an agreement to convey starts the process.

The Title Company will verify what taxes (if any) are owed on the property through various assessor collectors.

Copies of documents are gathered from various public records: deeds, deeds of trust, various assessments and matters of probate, heirship, divorce, and bankruptcy documents.

Verification of the legal owner and debts owed.

Appropriate forms are prepared for conveyance and settlement.

An Escrow Officer oversees the closing of the transaction: seller signs the deed, you sign a new mortgage, the old loan is paid off and the new loan is established. Seller, Realtors, attorneys, surveyors, Title Company, and other service providers for the party are paid out. Title insurance policies will then be issued to you and your lender.

There are two types of title insurance: coverage that protects the lender for the amount of the mortgage, and coverage that protects your equity in the property.

Both you and your lender will want the security offered by title insurance.

Title agents search public records to determine who has owned any piece of property, but these rerecords may not reflect irregularities that are almost impossible to find. Some examples: An unauthorized seller forges the deed to the property; an unknown, but rightful heir to the property shows up after the sale to claim ownership; conflicts arise over a will from a deceased owner; or a land survey showing the boundaries of your property is incorrect. Title insurance will safeguard you against problems including those events an exhaustive search won’t reveal for a one-time charge.